French start-up Indy has actually just recently closed a brand-new financing round of $44 million (EUR40 million) with BlackFin Capital Partners leading the round. Indy began as an automatic accounting platform for freelancers and other self-employed individuals.

The business has actually been gradually repeating on its item to end up being an all-in-one platform for freelancers, from accounting to business development, tax preparation, invoicing and (quickly) organization banking. It’s a fascinating example of the favorable results of bundling in a software-as-a-service business. And it might motivate other business owners resolving an extremely fragmented market of possible clients.

As long as you’re running a business with no staff member, Indy wishes to use all the administrative and financing tools that you require to run your company. It’s developed for freelancers, self-employed individuals, physicians, designers, legal representatives, and so on.

Other financiers in the current financing round consist of La Maison and iXO. Indy closed its financing round this summer season. While the start-up didn’t wish to share its evaluation, the business stated that it’s greater than the business’s appraisal after its previous EUR35 million financing round ($38.3 million at today’s currency exchange rate).

Image Credits: Indy

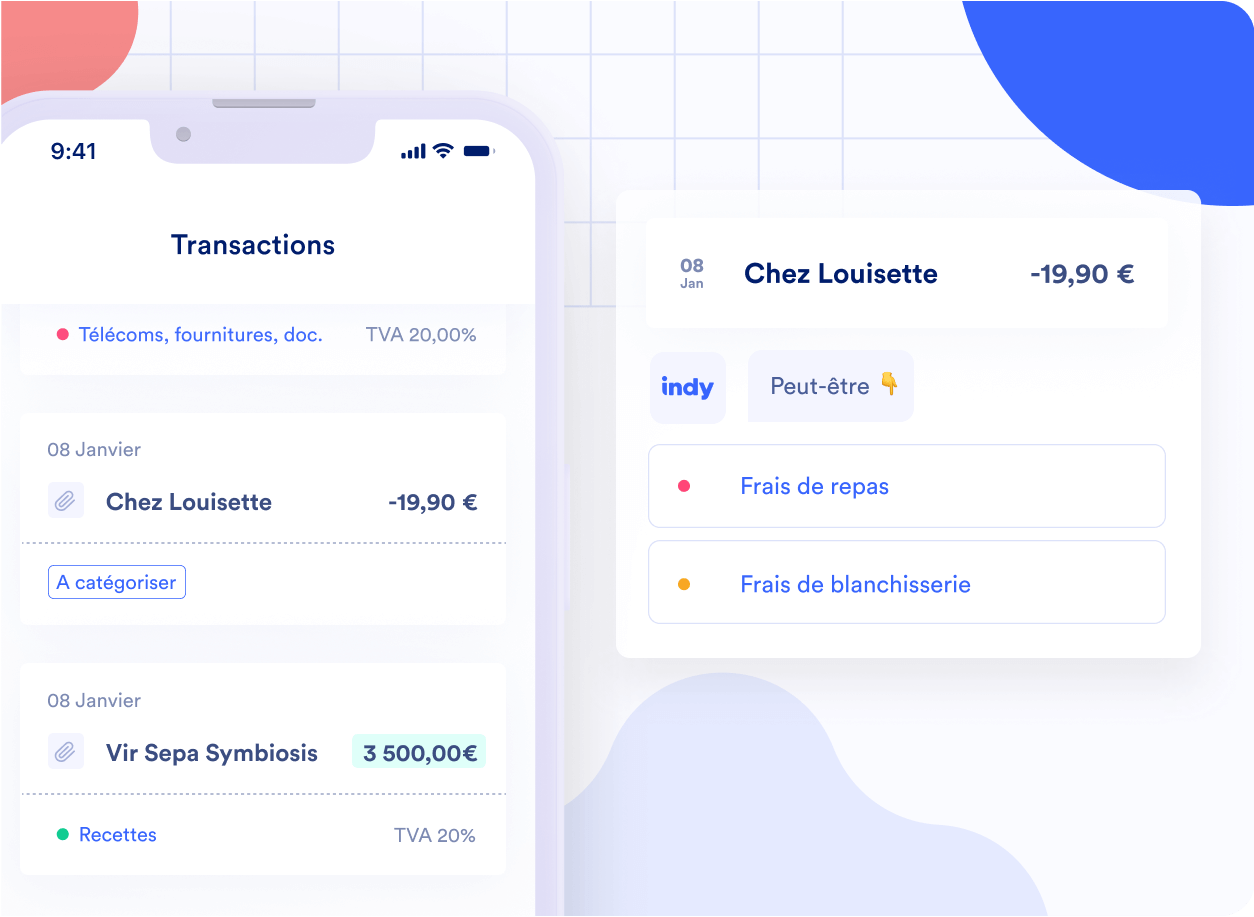

Indy’s core function stays its automatic accounting function. When you develop an account, you can instantly begin integrating your savings account with Indy so that previous and future deals are immediately brought.

After that, Indy attempts to classify each deal immediately. In many cases, users need to suggest the kind of deal in the app. Consumers include an invoice to each deal– VAT is instantly identified and invoices are then immediately archived and can be utilized in case of a tax audit.

At the end of the year, Indy can pre-fill tax return and send them to the business tax administration straight. Indy manages VAT returns.

Indy’s accounting tools are totally free to utilize permanently. As quickly as you wish to create tax return and send them, you need to pay a month-to-month membership. It stays much less expensive than employing an accounting professional.

“As we are on typical 4 to 5 times more affordable than a chartered accounting professional for the tax preparation part, there are many individuals who are utilizing our complimentary services and who will likewise sign up for our paid services. It’s up to them, they can likewise choose to employ an accounting professional,” Indy co-founder and CEO Côme Fouques informed me.

Item bundling playbook

With this basic item positioning, Indy handled to encourage 10s of countless paid customers. The business hasn’t been standing still as it rolled out other items to turn Indy into an item suite.

You can now develop quotes and billings from Indy and keep them in your user account. Obviously, you can constantly utilize Word or Excel for these files, however there are some advantages in having those files in Indy straight. When a customer pays a billing with a bank transfer, Indy can immediately mark a billing as paid.

Before you can utilize an item like Indy, you really require a business to expense consumers. In France, even if you’re a part-time freelancer trying to find extra earnings, there is some documents included and there are several alternatives.

The start-up assists you make the right choices when you develop your business. Unlike standard business production services, Indy provides this service free of charge as long as you begin a membership– however you can cancel that membership whenever you desire.

These items increase the item stickiness and users are most likely to advise Indy to other self-employed individuals. The sales funnel works especially well as an excellent part of individuals who desire to end up being freelancers will have to choose a business development service.

The next action is clear: Indy is going to end up being a fintech start-up. In simply a couple of months, the start-up will use a complimentary service savings account with a payment card. When once again, it makes good sense to bundle this service as existing clients need to change in between their banking app and Indy to manage their company financial resources.

Existing business dealing with service banking, such as Qonto and Shine in France, focus greatly on little and medium business. They do not have a fundamental item offering with standard functions that would work well for freelancers. “Business banking for a self-employed individual is quite fundamental– they wish to send out cash by means of a transfer, get cash by means of a transfer, have a payment card, which’s all there is to it,” Fouques stated.

And Indy can then utilize this fintech angle for other services. The business might use brand-new payment approaches for billings, such as online card payments, QR code-based payments or utilizing the smart device as a contactless card reader.

“As we provide all those functions in the very same service, we make big economies of scale and we conserve cash on user acquisition expenses,” Fouques stated. “This indicates we can provide an entire series of services complimentary of charge– services which would otherwise be paid services elsewhere. At the very same time we have a hyper-healthy, hyper-scalable design.”

Some business have actually determined the very same issue in the U.S., such as Found and Lili — they’ve both raised around $80 million according to Crunchbase information. Indy isn’t going to complete head-to-head with these well-capitalized business. Rather, the French start-up is taking a look at other European nations to see if it can reproduce its service in other markets.

Indy is still really much focused on its home market as there are millions of self-employed individuals in France. The marketplace chance is currently essential. And it seems like Indy has actually discovered the best circulation technique.

Discover more from CaveNews Times

Subscribe to get the latest posts sent to your email.

![Exploring the Serene Beauty of Nature: A Reflection on [YouTube video title]](https://cavemangardens.art/storage/2024/04/114803-exploring-the-serene-beauty-of-nature-a-reflection-on-youtube-video-title-360x180.jpg)